My husband and I have an automated system that funnels a certain amount of money into our savings account each week. Just last year, however, it hit me that time slips away quickly, and we needed to start thinking about saving money for Haiden and Piper’s future education. With current estimates showing that a college education will cost at least $36,000 a year (at an in-state, public university that doesn’t include housing costs, books or additional expenses!), I knew we had to start saving if we wanted any hope of being able to help our children with the burden of educational expenses.

After a few conversations but no real action on the topic, I finally decided that starting to save with something, even something small, was better than doing nothing. So new accounts were opened and we’ve added automatic savings into those accounts, too.

I don’t feel great for admitting this, but the truth is that the money is slowly, very slowly, growing in plain old savings accounts with those terrible interest rates that go hand-in-hand with our economy. Again, I know that it’s better than nothing, but I’ll be researching a better plan of action for that money within the next few months to get it in the best possible place for education savings.

The Gerber Life College Plan was designed to help parents like me save for my family’s future. With guaranteed growth, flexibility, and affordable fixed monthly contributions, this program might be the right choice for you and your own children. You can even compare the features and benefits of the Gerber Life College Plan with other savings options, like 529 plans, traditional savings accounts, bonds and more!

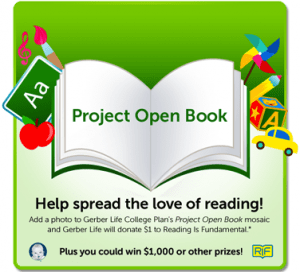

Gerber Life is also hosting a great sweepstakes! Visit the Gerber Life Insurance Company page on Facebook to upload your baby’s photos to the Project Open Book picture mosaic. For each photo added to their mosaic compilation, Gerber Life will donate $1 to Reading Is Fundamental, a great nonprofit organization that provides books to children in underserved communities across the country. In addition to helping these deserving children you’ll also be entered to win $1,000 and other great prizes!

I’m also excited to offer a giveaway in conjunction with the Gerber Life College Plan. One lucky reader will win a $100 Target gift card!

There are some great ways to earn extra entries into this giveaway! All mandatory and extra entries must be submitted within the Rafflecopter Giveaway box below.

If you’re reading this article in an email newsletter, feed reader or a mobile device, you may not see the above Rafflecopter box. Please visit babygoodbuys.com and enter the giveaway there.

a Rafflecopter giveaway

All entries must be done in the giveaway box above.

As always, if you have any trouble entering this giveaway, or if you have any questions, please contact me!

I wrote this post while participating in a campaign for Gerber Life. I received a gift card to thank me for taking the time to participate.

LaShae says

We’ve been advised to start saving while they are young.

Lynn says

Start saving as soon as you can.

Elizabeth C. says

It helps to remember anything is better than nothing. We also put away any monetary gifts that our daughter receives.

amy says

the most helpful tip i’ve gotten is ‘start early’…especially now that we have 2 little ones! college only gets more expensive & scholarships aren’t a gaurantee. i would like to my kids to have as small (if any) students loans as possible.

Katie says

start early

Rebekah {honeyandcheese} says

To start early! 🙂

Katy Morgan Campbell says

The best advice anyone has given me would be to start saving early with an intentional goal (ie…know what number I would like to reach and use a means reasonable in meeting that goal). We spoke with a financial planner and have both a 529 (the UESP, as it seemed to offer the best package, although we live in another state) and have started investing in a Mutual Fund. We don’t make much money, but my husbands parents saved from the beginning and were able to send all 4 of their children through college debt free. They started early (after paying off all debt!!!!) with an intentional plan – with dedication they succeeded. That is my hope for our family!

michael m says

start saving on day 1!

jeannine s says

The best adivce I got was to take out $20 a week automatically when they are born and put into bank account

Jennifer says

That you can do a 529 in another state, even if you don’t live there. We weren’t happy with the one in our state so we signed up with another program that better meets our savings goals and financial personality.

Harmony B says

start saving early

amanda says

we put $150 a month into a savings account for our 2 year old. he can use it for college, or in the case he gets a scholarship, he can use it for a home some day.

Kathy says

We need to especially start early since we will have 3 in college at the same time 🙂 We are saving $100 per month for each of them right now.

shelly says

Start early and don’t put accounts in your child’s name.

leslie rodriguez says

Saving since the kids were born.

Heather says

Start saving early and have your savings direct deposited, that way it doesn’t get lost or forgotten.

Rachael says

We started a college fund right before our daughter’s first birthday and asked grandparents to contribute to it instead of buying her birthday gifts. She won’t even notice the “lack” of toys- at least for a few years! 🙂

Kathryn C. says

We signed up for Upromise and started at 529 account for both children. Any money that they get for birthdays and Christmas is put into this account in addition to us contributing to it on a monthly basis.

Rebecca Mockbee says

This is something I need to start doing!

MARGO says

Start before they are born!

Mary Happymommy says

The best tip is to start saving right away.

Janice Cooper says

Start saving immediately and put money in a safe account

Sherrie says

We’ve been told to start early. We are slowly moving too, but did start when the kids were born. Also have a upromise. Every little bit helps!

Elena says

Start saving early

rachel says

save for your kids when they’re young…until they can save themselves!

Gray says

I have a 529 in Utah since they are one of the best.

brenda says

start saving right away

Melissa says

Start right away. Or work at a college like I do and get free tuition for your child!

Kristen says

Something is better than nothing! Good for you for starting to save to help out your kids.

Summer says

The best advice I received was to start a savings account as soon as your child is born and start putting money they receive as gifts in it as well as putting a monthly deposit into the account. Even if it is $10/month it will add up!

Sarah says

Start as early as you can!

meredith says

the tip i received was start early and hope they choose a state school

Christina Skinner says

The best tip was to start setting aside the a set amount every month starting now.

Brooke Upchurch says

To start saving now and putting the money into a steady stock that won’t take a dive for my 7 month old son.

Amanda Sakovitz says

Save as much as you can as early as possible and look for good interest rates.

megan h says

I need to do this thanks for the reminder. Start early

sarah m. says

Most helpful tip…start early!

Carol W says

Save early and often! The thought of paying for college scares me!

Tina M says

start early!!

D Schmidt says

To start saving as soon as they are born and to put money in at birthdays and Christmas as opposed to purchasing toys they become bored of within 5 minutes.

steph says

dont forget to account for BOOKS! so $$! and make the student work for it too 🙂

Monica Steele says

To start saving as soon as they’re born. My step-dad’s grandparents always put money in our college savings account for Christmas each year.

angela dupree says

Any money my child get from the holidays goes into the college fund.

Mary Beth Elderton says

A savings tip for a widowed single mom: Put all the change and up to 3 single bills from your purse into a safe place every day. Sometimes it’s just very small change. Sometimes it’s $3 plus change. Then hope for every scholarship possible and everybody works. This is how we got my son through his undergrad with no loans.

For those who can–start saving now.

Jen says

When times are lean, put away just a little something (however small) that you won’t miss every week. Then when things are better, set a goal amount to contribute and stick to it. Everything adds up, even the tiny amounts.

jennifer lane says

Start saving early and put money in a college fund regularly just like its any other important bill!

Jessie C. says

Plan ahead and start early

Becky Horn says

The best tip is to start to save early.

Katy P says

To start saving as early as you can

KAthy S says

Start saving the first year of your child’s life.

amy pugmire says

start saving while they are young. even if its 5 dollars a paycheck. everything counts

Molly Bussler says

Start when the baby is born, that way, it will be easier.

E. G. says

Start Now

susan says

Most helpful advice was to save at least a little each month (it all adds up).

Melissa says

Start early and be dedicated to saving.

Paula says

The earlier the better 🙂

Debbie jackson says

start early and involve your child in saving

katie says

start saving while they are young and what you can.

Janet Vickers says

Start saving now, even if you can only put $10 a month in the account.

Jessica says

Best advice I’ve received about any sort of investing: Start early and be patient.

Anissa says

The best advise I got was no matter how late you start make sure you start as every little bit helps. Even a couple hundred when they are in school can still make a difference.

jennifer says

The best tip? Start saving as early as possible, even if it’s not much!

Jennifer says

The best tip I got about saving for college for my child was to start as early as possible

Ashley Hatten says

start saving early, even $10 a week makes a huge difference! college is getting more and more expensive!

Jacqui says

Start putting money away now (she is only 5 months!

Kristen Ruby says

Start now, when they are young….it’s too hard when they get older.

Katherine D. says

RENT TEXTBOOKS!

Donna B. says

Start early ans save regularly, even if it’s only $10/week to start.

Julie Schultz says

It’s never too late/early to start saving!

Jennifer M says

I’ve always been told to start saving early.

Kris says

start to save early (easier said than done!)

Emily E says

The sooner you start saving the better . A dollar saved now is worth a lot more than a dollar saved 5 years from now.

Serena Stone says

Most helpful tip – start saving even before you plan to get pregnant.

Vickie Couturier says

its never too early to start saving

Vickie Couturier says

tweet

https://twitter.com/#!/vickiecouturier/status/163010376110317569

would NOT let me enter in the blank

Laura says

Start early…setup an account and have money transfer every week, even if it’s $25

Andrea says

Most helpful tip…save right away!

anna pry says

nobody ever told me to save for college and i’ll be paying for it for the next 40 years!

julie says

every little bit helps and when u save, put it in a separate account so you won’t touch it:)

jmatek AT wi DOT rr DOT com

courtney b says

save $5 a week and it will add up!

Becky M says

Start saving early!

clarissa says

let them earn their own money…they will appreciate it more some day

Will says

save as early as possible

LB says

It is never too late to start! Don;t give up because you haven’t started yet!

anash says

the best tip is to go to college online, you save more money and take it more serious! Thanks for the chance to win!! What a lovely giveaway

anashct1 [at] yahoo [dot] com

Chandra A says

Start early and encourage family to give money to put into savings instead of gifts

Maureen says

START SAVING EARLY!!!

Nicole Larsen says

The most helpful tip for me was to start the college fund as soon as my daughter was born and not to wait!

Rebekah S says

I would say to start early and be consistant!

Christina says

Start saving when they are born! Every little bit you can add helps.

Susan F says

Any money gifts we put away for savings!

Trisha Burgess says

To start as soon as possible!

Addison Kat says

Start saving now!!

Denise says

Every little bit helps, and don’t do it at the expense of your retirement fund.

Laura Tetrault says

I think the best advice I’ve heard is to start now with something small. Once you are in the habit you can up the amount as you can afford to.

Isis Sample says

I know the feeling!!! it’s a good idea to open several accounts, here’s hoping interest rates go up & we can save more!!!

nannypanpan says

the best advice was from my dad was to start early and save as much as you can

nannypanpan at gmail.com

Jessica Frye says

The best tip I have received is to save from day one and you can never plan too much!

Tracy Robertson says

to start saving early…even before your child’s birth if possible.

Cory says

Start saving early.

Lisa Brown says

I was told to start saving early, and to keep your grades up so you could qualify for any scholarships that might be available.

jslbrown_03 (at) yahoo (dot) com

brooke t says

That you can switch states!!

Sonya Morris says

Open a 529!

linda brooks says

To put back a little each week

Rachel V says

Start when they are young

Heidi says

Short and simple….start early! 🙂

Liz says

Start saving before they are born. Also when they are young and people want to give gifts ask them to get either bonds or money for college. It helps and they dont notice when they are young.

Staci A says

To start as soon as possible!

Deanna G. says

Start saving as early as possible.

Marie says

The earlier you start saving the better.

Sara Wood says

Start saving now, it is NEVER too early!!

Rachelle says

Have your children save too. But I am going to get busy saving starting tomorrow. Have not done a very good job of it.

Claire says

Definitely start saving early & put it in a BANK!!

Kimberly Bauer says

Start early and look into scholarships

Kenia says

To start saving early and to open a college savings account at the bank. To use uprosmie so you can save money.

Meg says

Dear Marybeth,

On behalf of Reading Is Fundamental (RIF), thank you for supporting Project Open Book. All the money raised through our partnership with Gerber Life helps us provide new books to the kids who need them most. In low-income neighborhoods in the U.S., there’s only one book for every 300 children. For many RIF kids, their RIF book is their only book.

Learn more about RIF and our efforts through our newsletter, Facebook and Twitter.

https://bit.ly/RIFeNews

https://www.facebook.com/ReadingIsFundamental

https://twitter.com/#!/rifweb